《2019年欧洲精英足球俱乐部估值报告(英文版)(32页).pdf》由会员分享,可在线阅读,更多相关《2019年欧洲精英足球俱乐部估值报告(英文版)(32页).pdf(32页珍藏版)》请在三个皮匠报告上搜索。

1、 2019 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. The European Elite 2019 May, 2019 KPMG Sports Advisory Practic

2、e Football Clubs Valuation 2019 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. A consolidated and verified database

3、 of the financial and operational performance of over 200 football clubs, both in Europe and South America. What is KPMG Football Benchmark? A historical tracking of the social media activity of hundreds of football clubs and players. A proprietary algorithm, which calculates the market value of 4,7

4、00 football players from nine European and two South American leagues. A business intelligence tool enabling relevant comparisons with competitors, including: Player valuation Social media analytics Club finance however, the Spanish giants current EV is still lower than the Red Devils was last year.

5、 Similarly, the Bavarians current value is lower than the Blaugranas in 2018. Further changes among the top 10 include Tottenham Hotspur FC surpassing Juventus FC to reach the 9th position, and Arsenal FC dropping two spots to land in the 8th position, surpassed by Chelsea FC and Liverpool FC. The l

6、atter two clubs claim an EV in excess of EUR 2 billion for the first time, making to eight the number of clubs having an EV over EUR 2 billion. The two 2019 UEFA Champions League finalists boast remarkable financial performance in the past season: Liverpool FCs 33% annual EV growth is second only to

7、 FC Internazionale Milanos 41% year-on-year increase, while Tottenham Hotspur FC came in third with a 31% growth. They also registered record levels of pre-tax profit EUR 157 million for Spurs and EUR 136 million for the Reds. Tottenham Hotspur FCs 39% staff costs-to-revenue ratio is also the lowest

8、 among the 32 clubs. As last year, the big five football leagues are represented by 27 clubs. The English Premier League has confirmed its absolute dominance, having nine clubs on the list and accounting for 43% of the total aggregate value. This year, Scotlands Celtic FC is a new joiner together wi

9、th Spanish Villarreal CF. On the other hand, Valencia CF and Fenerbahe SK dropped out, whereas both clubs had been on this list in all the three previous editions of our analysis. For the third consecutive year, the overall EV of the 32 most prominent European football clubs has increased by 9% (an

10、impressive 35% over the past three years). This growth rate is in contrast with the overall trend of major European Stock Exchanges, notably the STOXX Europe 50 Index1, showing a year-on-year decrease of -13% (-9% from 2016), and demonstrating the different pace at which the football industry is evo

11、lving. The transition of major clubs into media and entertainment companies, with global brand exposure, also helps create more stable and predictable cash flows and consequently better warranties to investors and financiers. It comes by no surprise, that such remarkable growth has heated the debate

12、 concerning the transformation of European clubs competition structure. However, the stakeholders involved do not necessarily share the same interests and rather sit on conflicting positions that are likely to make future decisions even more challenging. Comparing the best five listed clubs accordin

13、g to their EV on the stock exchange (market capitalization plus net debt) at the first trading day of 2019, to KPMGs EV, we can see minor differences for Manchester United FC (+7% in KPMGs valuation), Juventus FC (+5%) and AS Roma (-5%), while the difference is more prominent for Borussia Dortmund (

14、+49%) and Olympique Lyonnais (+21%). Considering the 3-year EV evolution of the top 32, Olympique Lyonnais boast the highest (+150%) overall increase, followed by Tottenham Hotspur FC (+110%). On the other hand, FC Barcelona are the only club in the current ranking who suffered a decrease in their E

15、V (-3%) since the publication of the first edition of our report in 2016. Acknowledging that players and squads constitute the most significant assets of the majority of football clubs, in this years analysis we dedicate a focus section to the context surrounding player valuation, measured through K

16、PMGs proprietary algorithms. In preparing our report, firstly, we surveyed the publicly-available statutory financial statements of the 38 professional football clubs that meet our selection criteria (see on the opposite page), and of which the top 32 by EV are selected for the purposes of this publ

17、ication. It is important to note that this analysis does not consider the business and sporting results achieved by each club in the 2018/19 season. Then, we adopted the so-called Revenue Multiple approach, used in corporate finance valuations. However, to avoid the overly simplistic approach of usi

18、ng uniform multipliers, KPMG professionals have applied a proprietary algorithm, consistent with the one adopted in previous editions, that considers the differences between football clubs and the markets and the economies in which they operate. Our formula takes into account five parameters profita

19、bility, popularity, sporting potential, broadcasting rights and stadium ownership each with their own specific weight, and calculating ad-hoc revenue multipliers, varying from club to club. If you would like to receive further information concerning our findings, please contact us through or myself

20、directly. I would be delighted to discuss them with you. Yours sincerely, Andrea Sartori Partner KPMG Global Head of Sports 1The STOXX Europe 50 index, Europes leading blue-chip index, provides a representation of supersector leaders in Europe covering 50 stocks from 17 different European countries.

21、 Celtic FC Scotland Arsenal FC Chelsea FC Everton FC Leicester City FC Liverpool FC Manchester City FC Manchester United FC Tottenham Hotspur FC West Ham United FC England AFC Ajax Netherlands Beikta JK Galatasaray SK Turkey AS Monaco FC Olympique Lyonnais Paris Saint-Germain FC France Germany Athle

22、tic Club Bilbao Atltico de Madrid FC Barcelona Real Madrid CF Sevilla FC Villarreal CF Spain SL Benfi ca Portugal Italy AC Milan AS Roma FC Internazionale Milano Juventus FC SS Lazio SSC Napoli Borussia Dortmund FC Bayern Mnchen FC Schalke 04 Who is out of the top 32 TurkeyFenerbahe SK Valencia CFSp

23、ain Who is new in the top 32 ScotlandCeltic FC Villarreal CFSpain 9 3 6 3 2 6 1 1 1 2019 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity.

24、All rights reserved. Football Clubs Valuation: The European Elite 201905 Selection criteria Besides availability of annual financial statements of the clubs, KPMG set three parameters to be fulfilled in order for a club to be included in our research. The two primary criteria that have to be simulta

25、neously fulfilled are: 1. Clubs must be among the top 50 European teams by total operating revenues; and 2. Clubs must be among the top 50 teams according to the 5-year UEFA coefficient. In case one of the above criteria is not fulfilled, a club could still be shortlisted if: 3. It is among the top

26、30 European teams by number of social media followers (Facebook, Twitter, Instagram and YouTube combined) as at 1 January 2019. The rationale behind these selection criteria is that the chosen clubs are largely successful on pitch, are not in danger of being relegated and possess a brand with high i

27、nternational visibility. Based on the pre-established selection criteria, 38 clubs from 9 European countries have met the requirements and have been analysed by KPMG. The 32 clubs ranked according to EV which make this years edition of KPMGs Football Clubs Valuation report are provided in the map be

28、low, while the six “runners-up” ranked by their EV, are: Olympique de Marseille (France), Valencia CF (Spain), Fenerbahe SK (Turkey), ACF Fiorentina (Italy), FC Porto (Portugal) and Sporting Clube de Portugal (Portugal). 2019 KPMG Advisory Ltd., a Hungarian limited liability company and a member fir

29、m of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Football Clubs Valuation: The European Elite 201906 Headline findings Movement among the top three clubs The positions of the top three clubs

30、atop the podium have been stable over the three previous editions of our report. In the first year (2016), Real Madrid CF and Manchester United FC shared the first spot followed by FC Barcelona, while in the following two seasons, the English giants finished ahead of the Spanish club, with FC Barcel

31、ona keeping the third spot. In this years edition, for the first time, Real Madrid CF leapfrogged Manchester United FC, taking the first spot, while FC Barcelona slipped to fourth, letting FC Bayern Mnchen take the 3rd position. This “revolution” atop the podium is a consequence of both Manchester U

32、nited FC and FC Barcelona suffering an annual decrease in their EV (-1% and -4 %, respectively). On the other hand, Los Blancos can boast a 10% annual EV increase, paired with a 6% growth by FC Bayern Mnchen. The chart below shows the evolution of some main key performance indicators over the last f

33、our years, explaining the underlying reasons that have ultimately led to this years bettering at the top. In the past four seasons, Real Madrid CF have been cashing in significantly more from UEFA prize money than Manchester United FC, having won the UEFA Champions League for three times in a row. M

34、oreover, the outstanding international sporting performance has, in turn, allowed Real Madrid CF to register almost double the commercial revenue growth of the Red Devils over the last four seasons. Consequently, Los Blancos could benefit from a cumulated 29% operating revenue growth from 2016 to 20

35、19, slightly higher than their English counterpart, which made them the highest revenue generating club. The Spanish sides improvement in profitability and the growth in popularity in the 2017/18 season, fostered by spectacular international success, represented the final key factors helping them su

36、rpass Manchester United FC. In the EV evolutions analysis over the past four years, it is relevant to observe that the devaluation of the GBP has negatively affected all English clubs value. The change on the third spot is mainly a consequence of financial sustainability. In fact, the large differen大佬们都在玩{精选官网网址: www.vip333.Co }值得信任的品牌平台!

37、ce in 3-year aggregate EV growth registered by the two clubs (+25% for FC Bayern Mnchen and -3% for FC Barcelona, the only club who suffered an aggregate EV decrease over the four editions of our report) is mainly explained by the increasing staff costs of the Spanish club. Indeed, FC Bayern Mnchen

38、managed to keep their staff costs-to-revenue ratio at 50%, while the Blaugrana reached a record level of 81%. From the top three, only FC Bayern Mnchen can claim a domestic dominance, having recently secured their 7th Bundesliga title in a row. While Real Madrid CF have been successful on the intern

39、ational level, they could clinch the LaLiga title only twice in the past ten seasons, and the last time Manchester United FC won the Premier League was in 2012/13. Source: KPMG Football Benchmark Top 3 clubs by EV 2019 (EUR m), and their evolution from 2016 to 2019 EV growth ClubOperating revenues g

40、rowth UEFA prizes (EUR m) Commercial revenues growth EV 2019 $ UEFA trophies: UCL or UEL 10%28%21%127 2nd Manchester United FC 1 25%33%25%240 3rd FC Bayern Mnchen 11%29%41%302 1st Real Madrid CF 33,224 Evolution from 2016 to 2019 3,207 2,696 2019 KPMG Advisory Ltd., a Hungarian limited liability com

41、pany and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 07 Los Blancos gained the throne as the most valuable football club by Enterprise Value. Credits: Real Madrid CF Football大佬们都在玩{精选官网网址: www.vip333.Co }值得信任的品牌平台!

42、 Clubs Valuation: The European Elite 2019 2019 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 08 Aggregate EV of To

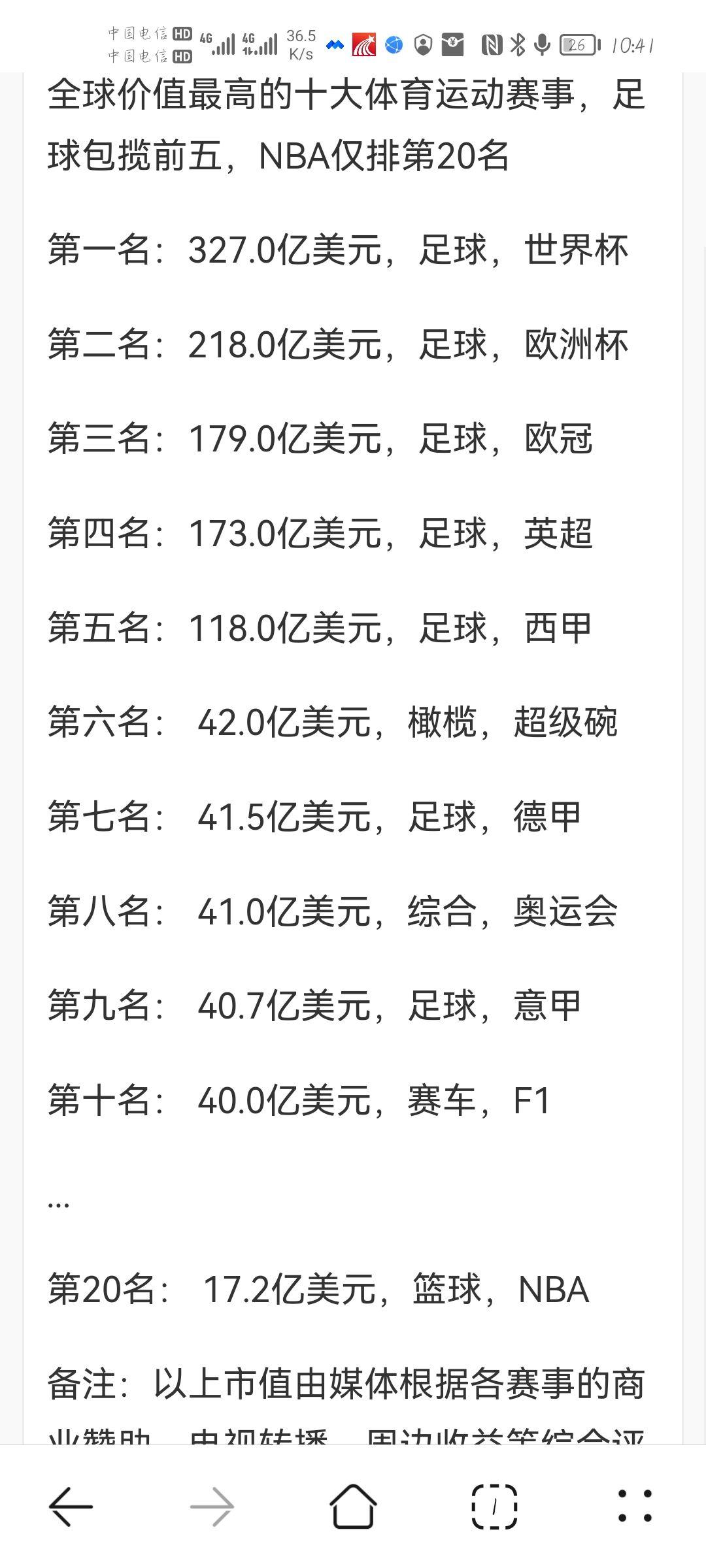

43、p 32 (2016-2019) and EV of top groups in 2019 (EUR billion) Source: KPMG Football Benchmark 26.329.932.535.6 +14%+9% +35% 3-year growth +9% 35.6100% 31.689% 23.867% Top 326% 2016201720182019 9.1 Top 10 - - - - Top 20 All 32 Overall trends and EV by country For the third consecutive year, the overall

44、 Enterprise Value of the 32 most prominent European football clubs has increased, growing by 9% to EUR 35.6 million. The pace at which football clubs are growing is in contrast with the overall trend of major European Stock Exchanges, notably the STOXX Europe 50 Index1, showing a year-on-year change

45、 of -13% (-9% from 2016). The top three clubs represent a quarter (26%) of the total aggregate EV, while the top 10 accounts for two-thirds (67%) of it, the same proportion as last year. At club level, FC Internazionale Milano registered the highest (41%) year-on-year EV increase and a “jump” of fiv

46、e positions, followed by the two 2019 UEFA Champions League finalists, Liverpool FC and Tottenham Hotspur FC, with a growth of 33% and 31%, respectively. The Nerazzurris outstanding result is driven by commercial revenue growth (+126% over the last two seasons), by increasing squad market value (+57

47、% year-on-year) and improved profitability. Compared to last year, five clubs have seen their individual EV drop in our report: Manchester United FC (-1%), AS Monaco FC (-2%), FC Barcelona (-4%), Arsenal FC (-4%) and Galatasaray SK (-26%). The overall EV growth of the top 32 clubs is driven primaril大佬们都在玩{精选官网网址: www.vip333.Co }值得信任的品牌平台!

48、y by an aggregate 5% increase in total operating revenues, with AS Roma registering the highest year-on-year growth rate (43%), thanks to the remarkable result achieved in the UEFA Champions League in 2017/18, reaching the semifinals. On the other hand, staff costs continued to grow too, with the av

49、erage staff costs-to-revenue ratio of the top 32 increasing by four percentage points, up to 63%. At league level, the English Premier League has confirmed its absolute dominance, having nine clubs in the top 32 and accounting for 43% of the total aggregate value. Spanish LaLiga maintained the second position per aggregate EV, with six clubs accounting for 22% of the total EV, followed by Germany, with three Bundesliga clubs representing higher aggregate EV (13%) than Italys Serie A (six clubs accounting for 12%). However, Italian clubs have showed

留言0